Troubled Intel’s tasty chips deal with Amazon could start turnaround

“It’s been an emotional couple of weeks at Intel, seeing so many friends and colleagues leaving the company,” Ryan Mackiewicz, a packaging manager at the legendary Silicon Valley company wrote on LinkedIn this week.

He added: “With that, it’s super exciting to see some very positive news for the company moving forward! Everybody may think we are done for, but Intel still has some fight left in us!”

Last Monday, the troubled American chipmaker finally had some good news for staff and investors, as it unveiled a multi-billion contract to make chips for Amazon. Intel also revealed it has secured up to $3 billion from the US government to help manufacture advanced chips for the military.

In a further boost it was reported on Friday that Intel had received a takeover approach from Qualcomm, the semi-conductor group, that would set a potential record-setting deal for the chip industry, according to the Wall Street Journal. Intel’s shares rose by 3 per cent on news of the possible bid to close at $21.84 on Friday, bringing its weekly gain to 9 per cent, but still down 54 per cent since the start of the year.

The announcements come six weeks after a bruising second-quarter earnings report, when Intel suspended its dividend and announced plans to cut 15,000 jobs as part of a drastic $10 billion cost reduction plan. It is also pausing the construction of plants in Germany and Poland by two years. The company’s cash flow has turned negative and it is weighed down by around $50 billion of debt.

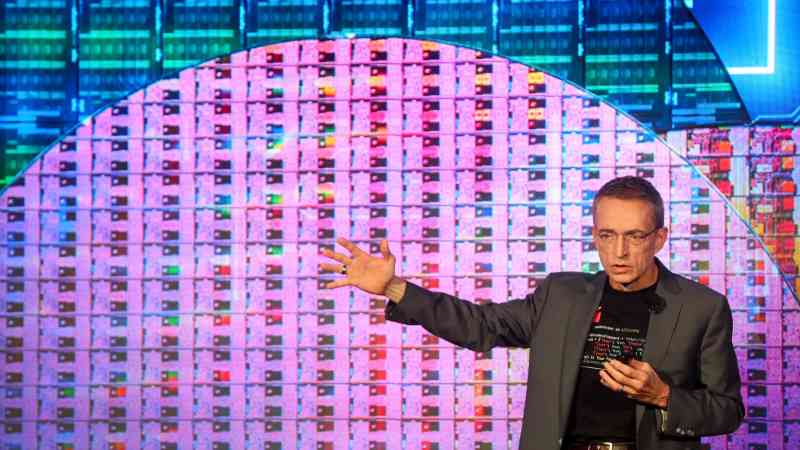

So, is the turnaround plan started under Pat Gelsinger, Intel’s chief executive, starting to work? Gelsinger, 63, who started his career at Intel in 1979 as a quality control technician, took over as chief executive in 2021 after nearly a decade running VMWare, an American cloud computing company. He has set out to undo the errors of previous Intel leaders who had let Intel fall behind rivals after decades dominating the PC chip space. “This is a national asset,” he told analysts after taking over as chief executive. “This company needs to be healthy for the technology industry, for technology in America.”

Founded in Mountain View, California, in 1968, Intel is the only American company that both designs and manufactures advanced chips. It introduced the world’s first electronically programmable microprocessor in the 1970s which became a key part of servers and PCs. Later, the company helped to develop the USB in the 1990s.

As recently as 2020, it was the world’s largest semiconductor company, with $77.9 billion in annual revenue, compared to chip designer Nvidia Corporation’s $16.7 billion and chipmaker TSMC’s $45.5 billion.

However, Intel was subsequently overtaken by competitors as it focused on chip technology known as central processing units [CPUs] and missed out on the rise of graphics processing units [GPUs] for artificial intelligence. The GPU hardware, which Nvidia claims to have invented in 1999, can perform mathematical calculations on large datasets in parallel and at high speed.

Intel has also failed to gain market dominance for chip manufacturing with its foundry business, launched in 2010. Instead, Taiwan Semiconductor Manufacturing Company (TSMC), and Samsung Electronics Co have taken large shares of the market.

Last year, amid the AI frenzy, Intel reported annual revenue of $54.2 billion, behind Nvidia’s $60.9 billion and TSMC’s $69.3 billion.

In contrast, Nvidia’s shares, which had slipped 0.4 per cent to $116.30 over the same period this week, are up 141 per cent since the start of the year. Nvidia’s market capitalisation of $2.9 trillion is around 32 times the valuation of Intel at $88.3 billion.

When Gelsinger took over as chief executive of Intel, he set out to invest billions in building new advanced chip factories around the world. However, the factories will take years to come online and bear fruit.

Some investors have called for Intel to focus on one area, either design or manufacturing. Gelsinger has decided to continue to pursue both, but is splitting the operations by spinning off its foundry, or manufacturing business, into an independent subsidiary, which invites other companies to make chips at its foundry.

Amazon joins Microsoft, which agreed a tie-up with Intel earlier this year to use its foundry to create its own custom computer chip earlier this year. Intel previously only made chips for itself and was able to charge a premium for them because it had the manufacturing lead. However, since losing its lead to rivals, its chips have become less competitive, putting pressure on margins.

Foundry as an independent unit is a positive, said analysts at Mizuho Securities, as it will help to allay concerns around transparency for customers. However, they said that ramping up scale will be key for improving margins.

Daniel Morgan, a fund manager at Synovus Trust Co, which invests in Intel, said: “I think in the past, they were trying to do too much, because they were losing ground in the CPU [central processing unit] space to AMD [Advanced Micro Devices]. They missed out on the AI wagon, so to speak, against Nvidia. And then on top of that, they’re trying to build all these foundries. And so [in] their core business, they were lacking.

“And yet, they were doing things above and beyond, like Nvidia is not going around trying to build foundries in the US. I mean, they’re focused on bringing out the Blackwell [AI chip], right? Whereas Intel was trying to do so many different things, and I think, hopefully this division between their chip initiatives and in terms of what they’re doing with the foundries is hopefully going to help them get back on track, because they’ve been off track, really, for a couple years.”

Investors are hopeful that geopolitical risk around Taiwan, where the majority of the world’s advanced semiconductor chips are made by TSMC, will boost demand for Intel’s foundry business.

Intel has benefited from the Biden-Harris administration’s Chips and Science Act, passed two years ago to provide tax benefits, loan guarantees and grants to encourage US companies to build chip manufacturing plants in the US.

Jon Peddie, a California-based semiconductor company analyst, said making foundry independent won’t dent TMSC’s business. However, he believes Intel will be able to steal business from smaller fabs [semiconductor fabrication plants], and possibly Samsung.

Intel has faced concerns over overheating of its central processing unit [CPU] chips, in a blow to Gelsinger who has recognised the importance of “exceptionally engineered and relentlessly innovative chips” which he believes “will be the determining factor in the next phase of innovation for virtually every industry”.

After the latest update, Wall Street will be closely following any news on Falcon Shores, the GPU Intel is due to release next year, as well as Intel’s Gaudi chips, which could steal some market share from Nvidia’s AI chips.

Investors are also hoping for a seamless launch of Granite Rapids, a new server chip designed to power intensive computing in data centres, which Intel is due to start shipping in the present quarter, as well as Lunar Lake, Intel’s “next-generation” AI chip which powers PCs. Production began in July with shipments scheduled to start in the third quarter of this year.

One of Gelsinger’s biggest challenges will be maintaining staff morale and pride in the company, after it has been knocked off its pedestal for the first time in decades. “With layoffs and problems with products, morale will be dampened, but the people I’ve spoken to have faith in Pat because he doesn’t BS people, never has, so he has their trust,” Peddie said.

Could the company ever regain its position as the world’s largest semiconductor company? “Probably not for a few years,” Peddie said. “It took years to diminish the company’s position, it will take almost as long to restore it.”

Post Comment